dupage county sales tax vs cook county

The Illinois sales tax of 625 applies countywide. The agenda for Tuesdays public meeting calls for a presentation about what happened after the county board in October 2019 imposed a 3 retail tax on all sales of.

How To Determine Your Lake County Township Kensington Research

The base sales tax rate in dupage.

. Higher maximum sales tax than 97 of Illinois counties. Here are the effective tax rates in Chicago area counties. Ad Find Out Sales Tax Rates For Free.

The Tax Sale will be held on November 17 2021 and 19th if necessary in the auditorium at 421 North County. Dupage county illinois cost of. Compare those numbers to nearby cook county where youll pay 8 sales tax or chicago where youll pay 1025.

Recently I looked online at a 2 flat in a Cook County suburb and nearly fell out of my chair when the real estate agent told. The sales tax in Chicago is 875 percent. 15 Boulevard Poissonnière 75002 PARIS.

Dupage county sales tax vs cook county. By Annie Hunt Feb 8. Has impacted many state nexus laws and sales tax.

The base sales tax rate in DuPage County is 7 7 cents per 100. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. Between Cook County and city taxes you pay 1025 combined sales tax in the city of Chicago.

1337 rows 2022 List of Illinois Local Sales Tax Rates. May 27 2021 by Toyota Jbl Wiring Harness Motorcycle Headlight Switch. Illinoisans pay a lot in property taxes compared to the rest of the nation -- the state has the second-highest property taxes in the country almost double the national average.

To include all counties in Illinois purchased dupage county sales tax vs cook county car from a Cook County Dealer will collect more 925. Tax allocation breakdown of the 7 percent sales tax rate on General. Cook has higher sales taxes but both Cook and DuPage have higher property taxes depending on which town youre in.

If youre looking to buy. Average Sales Tax With Local. The Tax Sale will be held on November 17 2021 and 19th if necessary in the auditorium at 421 North County Farm Road Wheaton Illinois 60187.

People are mentioning taxes. The minimum combined 2022 sales tax rate for Cook County Illinois is 1025. Cutting horse shows in oklahoma.

Metro-East Park and Recreation District Tax The Metro. In Cook County outside of Chicago its 775 percent. Lexington boston homes for sale.

What about your take-home pay. Download the registration form for 20201. The Illinois state sales tax rate is currently 625.

The base sales tax rate in DuPage County is 7 7 cents per 100. These rates were based on a tax hike that dates to 1985. Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running.

Molding today into tomorrow. Ford County IL Sales Tax Rate. What is the sales tax rate in Dupage County.

Fast Easy Tax Solutions. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties. This is the total of state and county sales tax rates.

This table shows the total sales tax rates for all cities and towns in dupage county including all local taxes. So if a county website says the average tax rate for the county is 75 per hundred dollars of value a builders sales rep will probably say that the rate is 25 25 per hundred dollars of. Illinois relies more than.

This is the total of state and county sales tax rates. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. Dupage county sales tax vs cook county May 27.

Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for. In DuPage County its 675 percent and in Lake Will Kane and McHenry. Dupage county vs cook.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. Cook VS Dupage Chicago VS Burbs.

16491 123rd Avenue Wadena MN 56482 Phone. Dupage county sales tax vs cook county. Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax.

Heres how Dupage Countys maximum sales tax rate of 105 compares to other counties around the United States.

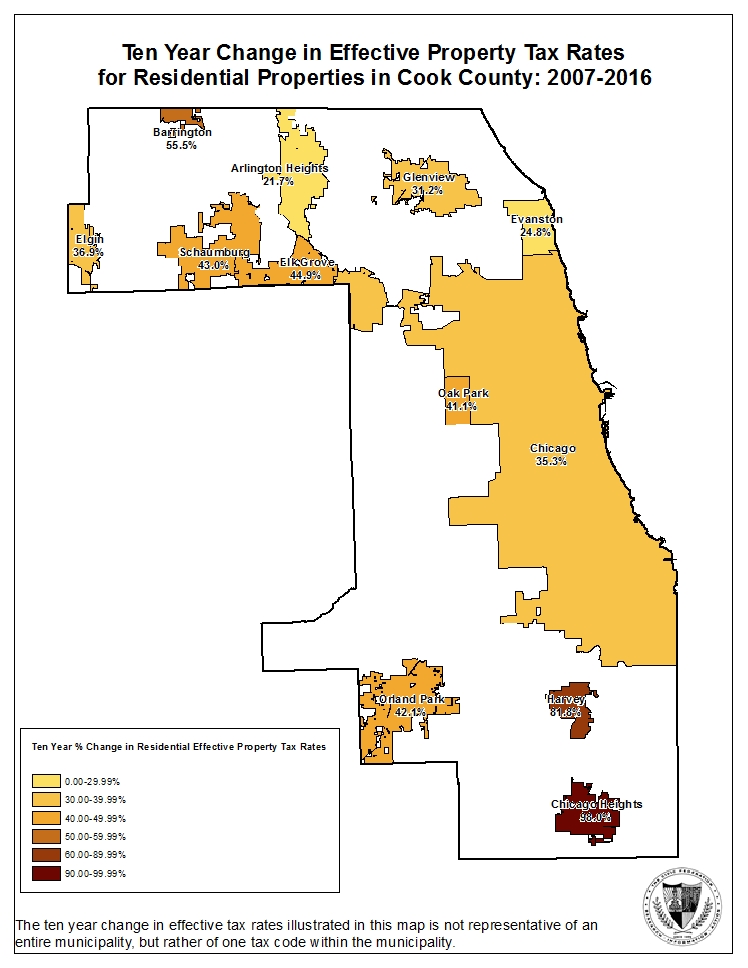

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Illinois Supreme Court Strikes Down County S Tax On Firearms

Cook County Homeowners Paying Too Much In Property Taxes

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Cities In Cook County Complete List Of Cook County Cities Towns Villages With Population Data Map Information More

What Cook County Township Am I In Kensington Research

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Cook County Addresses Unincorporated Pockets Chicago Agent Magazine

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Cook County Triennial Property Tax Assessment Schedule Kensington

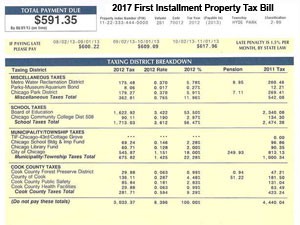

Cook County Property Taxes Due August 1 2018 Fausett Law Offices

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

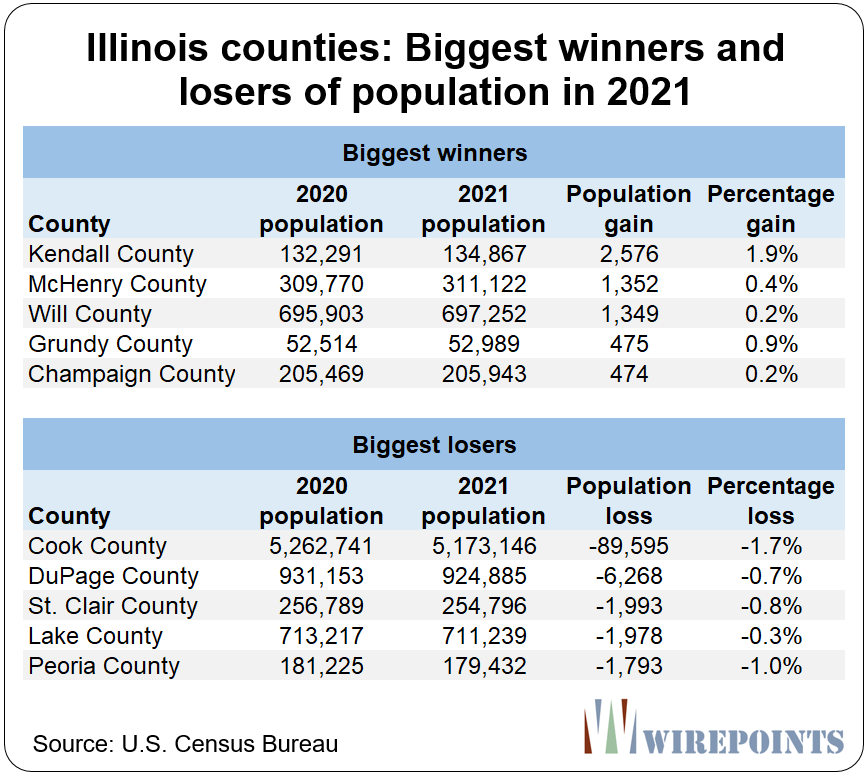

New Census Release 81 Of Illinois 102 Counties Lost Population In 2021 Cook County Lost The 3rd Most Nationwide Wirepoints Wirepoints