nassau county property tax rate 2020

Mar 04 2020 1027pm Updated on Mar 29 2021. The letters also contain information regarding 2017-18 taxes for local schools and other entities and also include an estimate for 2020-21 county taxes.

Nassau County Ny Property Tax Search And Records Propertyshark

Assessed Value AV x Tax Rate Dollar Amount of Taxes.

. 2020-21 Market Value 1. It is also linked to the Countys Geographic Information System GIS to provide. 45401 Mickler Street Callahan FL 32011.

New data from the Nassau Assessment Department shows the 22000 homeowners school tax obligation dropped by a total of 498 million in the 2021-22 tax year while their county and town property. As a result it is important that property taxes be grieved by either the property owner or tenant to ensure that the real property is not being over assessed. Moog also states that homeowners are more likely to see an.

Homeowners across Nassau County are due for changes to their property taxes with thousands set to see. Click here to search for your Parcel ID. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

Assessment Challenge Forms Instructions. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales. Fernandina Beach FL 32034.

Nassau County Department of Assessment ASIE 2020. The tax reassessment affects 400000 residential and commercial properties in Nassau County. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc.

In any taxing jurisdiction a property is taxed on the tax status date based upon current conditions. David Moog a Nassau County Assessor states that more homeowners will see their property value rise since becoming frozen in 2011. The Nassau County sales tax rate is 425.

The New York state sales tax rate is currently 4. On March 23 2020 the Nassau County Legislature passed the Reassessment Phase-In Act of 2020 RPIA formerly known as the Taxpayer Protection Plan. Hypothetical 2020-21 Taxes with the Taxpayer Protection Plan 3.

Homeowners across Nassau County are due for changes to their property taxes with. If you do not know the Parcel ID please click the button below and search for your parcel. 2020 Town and Special Districts 114724.

The Nassau County Sales Tax is collected by the merchant on all qualifying sales made. In Nassau County the next tax status date is January 1 2021. Assessed Value AV x Tax Rate Dollar.

Nassau County Tax Collector. This is the total of state and county sales tax rates. Walter Junior Boatright Building.

Rules of Procedure PDF Information for Property Owners. These higher taxes reflect rising property values. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

20222023 Tentative Assessment Rolls. If you are able please utilize our online application to file for homestead exemption. These increases are far higher than what is seen in an ordinary year and 2020 has been far from an ordinary year.

Calculate the Estimated Ad Valorem Taxes for your Property. Tax Liens are not redeemed nor reflected on this site. What the RPIA Does.

20192020 Final Assessment Rolls. 86130 License Road Suite 3. Current 2019-20 Taxes 2.

The Nassau County Property Appraisers Office makes no warranties expressed or implied concerning. How do I calculate my Nassau County taxes. COVID-19 Nassau County property taxes 145 pm Mon April 20 2020 Long Island Business.

Claim the Exemptions to Which Youre Entitled. What Are My Nassau County Property Taxes For 2020-21. The median property tax on a 48790000 house is 512295 in the United States.

The deadline to file is March 1 2022. More than 39000 homeowners will see increases of more than 3000 while 11000 will see increases of 5000 or more. 2019-20 Total Taxes 2195549.

According to the county taxes will rise for 52 of homeowners and decline for 48. Across Nassau County residential property values increased by 119 percent in the same time period. How to Challenge Your Assessment.

Please use one of the two options below to search for your property. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in. Fixing Nassau Countys Broken Assessment System - March 2 2020.

The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. Please click the button below to see if there are liens associated with this parcel. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Fighting property taxes in a pandemic Curran reassessed properties for the 2020-21 tax year according to Newsday after an eight-year freeze during the previous decade. 2019-20 School District 1658048. When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000.

The median property tax on a 48790000 house is 873341 in Nassau County. Do Your Due Diligence Or Let Us Do it For You How do I find out property taxes in my area. The median property tax on a 48790000 house is 600117 in New York.

Nassau County Property Appraiser. The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

Nassau County Department of Assessment 516 571-1500 General Information Provides information from the. Nassau County uses a simple formula to calculate your property taxes. You can pay in person at any of our locations.

Nassau County Tax Lien Sale. A recipe for disaster. January 30 2020 528 PM CBS New York.

According to media reports more than 60 percent of Nassau County homeowners will pay more in School Taxes in 2020 than they. 20212022 Final Assessment Rolls.

Us Homes Are Now More Valuable Than Ever House Prices Real Estate Redfin

Property Taxes In Nassau County Suffolk County

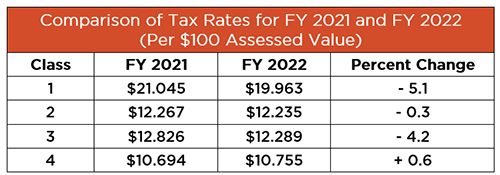

Update To New York City Property Tax Rates Property Taxes United States

Attom Single Family Home Property Taxes Increased To 328 Billion In 2021 Mortgageorb

Nyc Real Estate Buyers Agent Duties Hauseit Real Estate Buyers Agent Real Estate Buyers Nyc Real Estate

Property Taxes In Nassau County Suffolk County

Island Park School Officials Give Updates On Proposed Budget Lipa Case Herald Community Newspapers Www Liherald Com

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Make Sure That Nassau County S Data On Your Property Agrees With Reality

New York Property Tax Calculator 2020 Empire Center For Public Policy

Florida Property Tax H R Block

Tax Exemptions Town Of Oyster Bay

Happy Father And Son Setting Up Tent Outdoors Father And Son Happy Father Tent

Property Taxes In Nassau County Suffolk County

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Category Property Appraiser The County Insider

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer